Buying a car with a bonded title? Here’s what you should know

Buying a car can be a confusing process with a lot of questions. One very important thing to know before purchasing a vehicle is the standing of the title. A title marked “bonded” can quickly cause alarms because most people are unaware of what that means. Hopefully, we can clear up some of those questions for you here.

What is a bonded title?

A bonded title is just like a regular vehicle title you can still register, insure or even sell your vehicle. The big difference is that it is marked “bonded” which means it is connected to a surety bond.

Why does this vehicle have a bonded title?

Most likely, somewhere along the way the regular title for this vehicle was lost or damaged at a time between title transfers. This means there was not a way to prove the person in possession of the vehicle was the legal owner of the vehicle. Since there would not be a way to transfer the title normally, they would need to go through the process of getting a bonded title, including purchasing a surety bond.

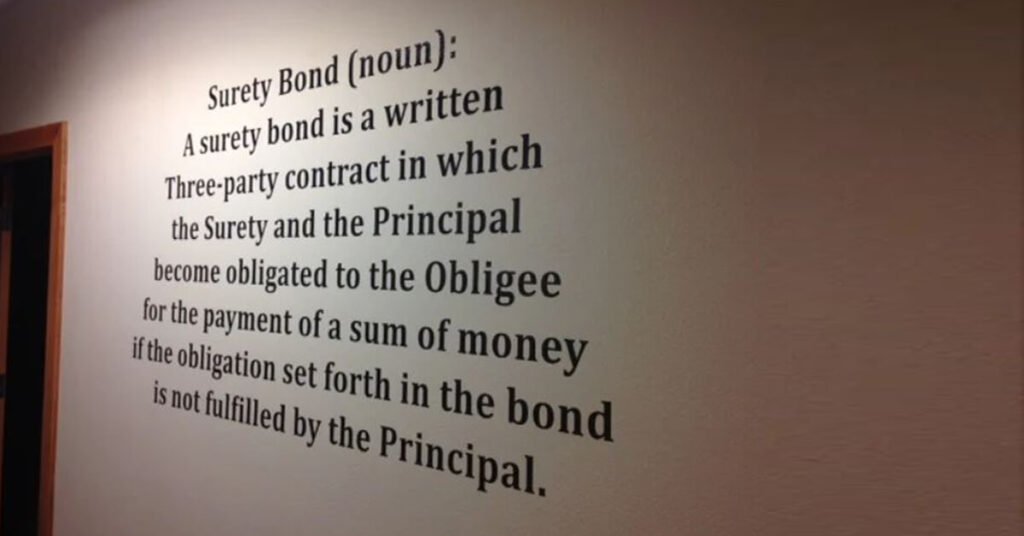

What is a surety bond?

Because the previous owner could not prove ownership with a title, the DMV did not want to just issue a new one. They want to make sure they are protected. They also have a duty to any previous title owner to protect them and not issue a bonded title if one shouldn’t be issued. The bond is a form of protection for the state and any previous title owners.

If someone comes forward and says that they are the legal owner of the vehicle and that a bonded title should not have been issued, they can make a claim on the surety bond. If the claim is determined to be valid, the surety company would pay the person a fair amount. It would then be the responsibility of the person who purchased the surety bond to repay the surety company.

What risks are there for me?

Claims on bonded titles are pretty rare because before a bonded title is issued there is typically some investigation made into the background of the vehicle done by the DMV. However, claims do happen.

If a claim is made, the good news is the surety bond does not transfer over as the title does, your name will not be attached to the bond itself. The person whose name is on the surety bond is the one responsible for repaying any claims, not you.

It is possible in the event of a claim that a judge could order the vehicle to be returned to the claimant. You would then need to seek compensation from whoever sold you the vehicle.

Will the title always be marked “bonded”?

No, after a set amount of years from the time of the bond purchase, you can go to the DMV to get a clear title. This time period is typically 3-5 years depending on your state’s laws.

Do you need to get a bonded title? Find out the requirements in your state here.

About Surety Solutions, A Gallagher Company

Surety Solutions makes the process of getting your surety bond quick and easy. We’re committed to uphold our culture of trust, honesty and great customer service.

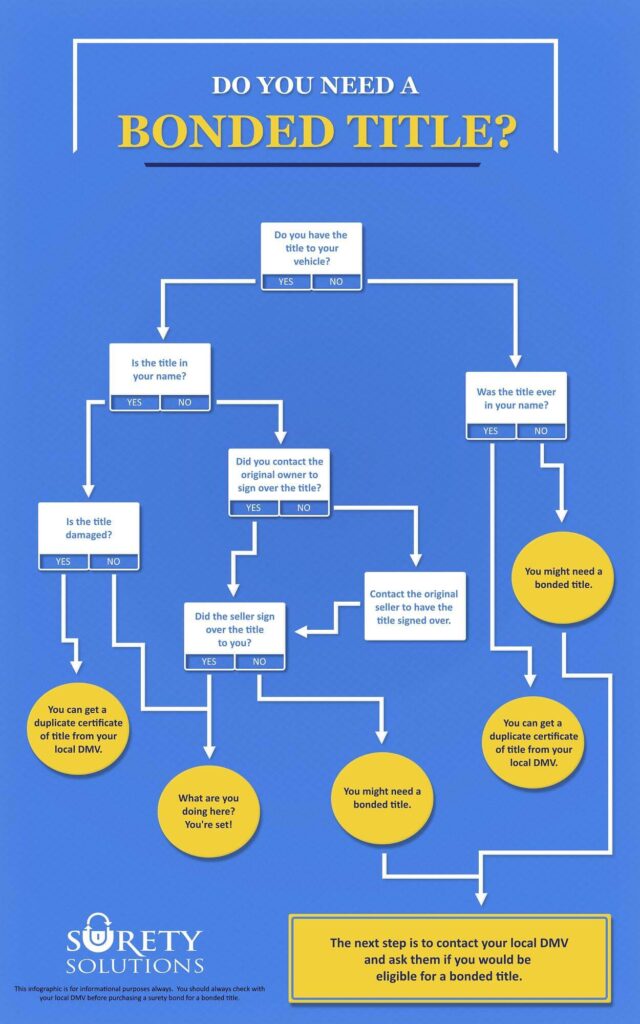

Do you need a Bonded Title?

Follow our simple infographic to see if getting a Bonded Title is the best option to register your vehicle.

Related Articles

If you bought a car without a title or were title-jumped, getting a Bonded Title might be your best solution. Read more…

Bought a vehicle, but didn’t receive the title? Don’t worry! You have options when it comes to registering your vehicle. Read more…

Find out what you can do if you are a victim of title jumping. Read more…

If a Vehicle Dealer did not provide a title or other paperwork to register your vehicle, you may want to file a complaint. Read more…

A Surety Bond is a written three-party contract in which the surety and the principal become obligated to the obligee for the payment of a sum of money if the obligation set forth in the bond is not fulfilled by the principal. Read more…

Rick Marsland is a Marketing Content Developer. He writes and creates content for Surety Solutions, A Gallagher Company's blog and website.

Classifications of Surety Bonds

Share on facebook Facebook Share on twitter Twitter Share on linkedin LinkedIn Contract Bonds (Sticks…