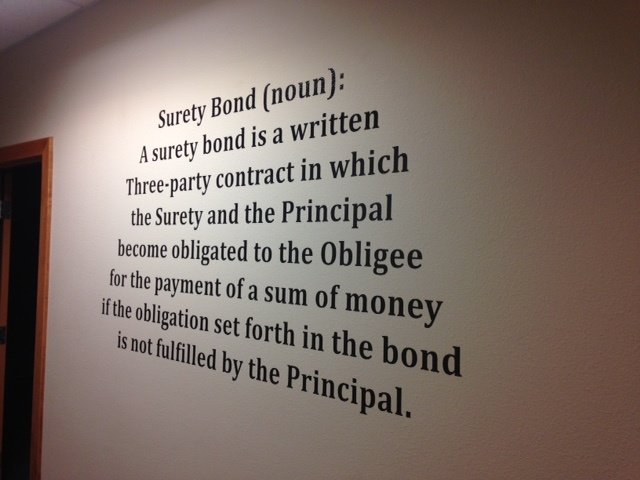

A surety bond is a written three-party contract in which the Surety and Principal become obligated to the Obligee for the payment of a sum of money if the obligation set forth in the bond is not fulfilled by the Principal.

A surety bond is a contract that guarantees you will fulfill your tasks and obligations.

The exact specifics your surety bond guarantees is dependent upon the type of surety bond you secure.

Short on time? Check out our interactive Surety Bond FAQ.

Here’s how a surety bond works: You sign an indemnity agreement and purchase a surety bond from a surety bond company. By doing this, you enter into a contract with the surety bond company and the person who requires the bond. The surety bond company is called the Surety and the person who requires the bond is called the Obligee. You are called the Principal.

One of two things will happen over the course of the bond term:

A claim is a complaint that you, the Principal, failed to fulfill your duties. It can also be a complaint that you acted unethically or against the law.

Surety bond claims come with a price. If the claim is determined to be valid, the surety bond company will pay the claimant up to the full amount of the bond. The surety company will then come to you for repayment. You are responsible for repaying the surety company every penny they paid out on your bond claim.

You can learn more about the bond claim process here.

Once the bond term expires, you will either need to renew your bond to remain in compliance with the law, or you might not need to renew your bond. The money you paid for your bond is non-refundable. You can learn more in our post “How Do I Cash a Surety Bond?”

There are over 50,000 different surety bonds in the nation.

Not sure what bond you need? Check out this post “What Surety Bonds Do I Need?”

With an insurance policy, the person who holds the policy is the one who is protected. Let’s say you get into a car accident. You would make a claim on your insurance policy, and if the insurance company determines the claim to be valid, they will pay you to cover the costs of the accident. The insurance company does not expect to be repaid and you go on your merry way.

With a surety bond, the person who holds the bond is NOT the one who is protected. Instead, the person who REQUIRES the bond is the one who is protected. If a claim is made on your bond and the surety company pays out on the claim, you are responsible for paying the surety company back.

You can learn more about the differences between surety bonds and insurance.

For more information on different types of bonds and what they do, check out our Youtube Channel.

You can also learn from the surety bond experts, the National Association of Surety Bond Producers (NASBP), and read their What Is A Surety Bond page.

About Surety Solutions, A Gallagher Company

Surety Solutions makes the process of getting your surety bond quick and easy. We’re committed to uphold our culture of trust, honesty and great customer service.

Get quotes for your Surety Bond

Need a bond? Get free quotes from top surety companies.

Related Articles

While it’s a common occurrence for people to confuse surety bonds with traditional insurance policies, they both function differently. Read more…

While often being compared to insurance policies, one big difference with surety bonds is how often you have to pay for your policy. Read more…

What do you do if someone makes a claim against your bond? Learn how the claim process for surety bonds works. Read more…

While searching for a surety bond, ensure the surety company you agree to work with is able to deliver on their services. Read more…

Insurance bonds (a.k.a. surety bonds) are either continuous or renewable. How do you tell the difference between the two? Read more…

Crystal Ignatowski is a Marketing Content Developer. She writes and creates content for Surety Solutions, A Gallagher Company's blog and website.

Secured by SSL.

Email: customercare@suretysolutions.com

4285 Commercial Street SE

Suite 110

Salem, OR 97302

(866) 722-9239