A surety bond cannot be cashed. A common misconception is that surety bonds function similarly to an investment-type bond or savings bonds. These products are very different.

This blog post was originally inspired by an Arvo post and a Quora post.

Investment Bonds – They Can Be Cashed

An investment bond is similar to an IOU. If you need to raise money to fund new projects, or if you need to maintain ongoing operations or refinance debt, you might want to invest in a bond. We love what CNN Money says about investment bonds:

Essentially, a bond is a fancy IOU. Companies and governments issue bonds to fund their day-to-day operations or to finance specific projects. When you buy a bond, you are loaning your money to the issuer – be it General Electric or Uncle Sam – for a certain period of time.

In return, you get interest on the loan, and you get the entire loan amount paid back either on a specific date (known as the bond’s maturity date) or at a future date of the issuer’s choice.

There are various investment-type bonds which you can read about here.

Summary: Investment bonds are debt instruments that can be cashed.

Surety Bonds – Cannot Be Cashed*

A surety bond is not an investment. Well, it can be considered an investment because you usually need to get a surety bond when you are starting a business, becoming licensed as a professional, or trying to perform some other sort of action such as construction or taking action in a court of law.

A surety bond is kind of like insurance for other people paid by you. If you perform your duties ethically and honestly, or if you promise to do whatever the bond contact says, the bond won’t need to be used.

But, if you fail to fulfill your duties, someone can make a claim against your bond kind of like someone could make a claim against your car insurance if you hit them. If the claim against your bond is determined to be valid, you are responsible for compensating and paying that claim.

Summary: Surety bonds cannot be cashed.* In fact, if a valid claim is made against your bond, you might actually owe money.

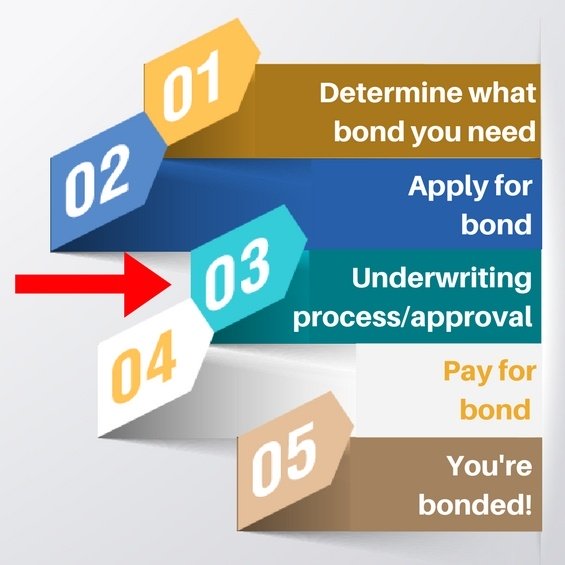

You can learn more about how surety bonds work here.

*The only exception to this is a cash bond. Generally, you see these used in the situation of bail.

Once a judge sets a bond amount for a defendant to be released on bail, the defendant has the option to either pay the entire amount upfront (cash bond) or contact a bail bondsman to put the money up (surety bond or bail bond). In this case of a cash bond, the cash can sometimes be refunded at the close of the case.

You can learn more about bail and bail bonds here.

Related Links: