If you have a business, you might have a surety bond. If you are a consumer, you might need to make a claim against a surety bond. Here’s all the information you need to know about surety bond claims.

Short on time? Read our other posts on Car Dealer Bond Claims or Mortgage Bond Claims.

When it comes to some bonds (License and Permit Bonds and Contract Bonds), a surety bond claim is a complaint that says you (the Principal) have not fulfilled your obligations and duties, or you have not followed the law.

Surety bond claims are understood to be intentional violations made by you or your business. They can also be misunderstandings with your customers, though.

Other bonds (like Lost Title Bonds) are different. A surety bond claim can be someone coming forward and saying that they are the true owner of the vehicle and you should not have been granted a bonded title.

Anyone can make a claim against your bond, and in most cases, the claim cannot be for more than the total amount of the bond. Claims can only be made against your bond during the time your bond is active.

More information about different bond claims can be viewed at the end of the article.

If a claim is filed against your bond, the surety company expects you to take care of the claim. This is your obligation under the indemnity agreement you signed when you purchased your bond.

If you fail to do this, the Surety will usually start an investigation to determine the claim’s validity. They will reach out to both you and the claimant.

One of two things will happen:

If the Surety finds the claim to be valid, they will remind you of your obligations under the bond. They will expect one of the following responses from you: a response to the claim, a resolution to the claim (this typically involves compensating the claimant for any financial loss or damages incurred) or a valid defense to the claim.

If you resolve the claim, the claim process ends.

If you fail to respond, resolve or provide a valid defense to the claim, the surety company will make a decision based upon the information and documentation provided by the claimant. In some cases, this could lead to the surety company paying the claim for you. If the surety company steps in and pays the claim for you, they will come to you for reimbursement of the settlement and any legal costs associated with it.

This is one way a surety bond differs from an insurance policy. While an insurance company does not expect to be paid back for a claim, a surety company does. You are responsible for cooperating with the surety company during the entire claim process. You are also responsible for paying back the surety company every penny they payout on a claim, including all costs associated with the claim.

If you are looking to make a surety bond claim, you’re on the other side of the fence. You are making a surety bond claim because you feel the surety bond obligations were not held up by the Principal.

Here are the steps you need to take to make a surety bond claim:

Look for this information in your contract or on your state’s licensing board website.

They might require you to submit a letter and/or other supporting documentation.

The claim will be determined to be invalid and no further action will be taken, or the claim will be determined to be valid. If the claim is valid:

Therefore, in the end, if a claim is considered to be valid, the bonded individual will be held responsible.

All surety bonds are different, therefore the claims will be different too. Here are some of the most common claims that could be made if you have one of the following bonds.

Learn more about Dealer Bonds in our Car Dealer License Guide.

Learn more about Court Bonds in our Court Bond Guide.

Learn more about Lost Title Bonds in our Lost Title Bond Guide.

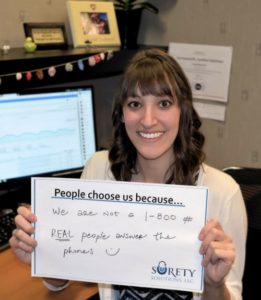

About Surety Solutions, A Gallagher Company

Surety Solutions makes the process of getting your surety bond quick and easy. We’re committed to uphold our culture of trust, honesty and great customer service.

Get quotes for your Surety Bond

Need a bond? Get free quotes from top surety companies.

Related Articles

While it’s a common occurrence for people to confuse surety bonds with traditional insurance policies, they both function differently. Read more…

If a Vehicle Dealer did not provide a title or other paperwork to register your vehicle, you may want to file a complaint. Read more…

While searching for a surety bond, ensure the surety company you agree to work with is able to deliver on their services. Read more…

While often being compared to insurance policies, one big difference with surety bonds is how often you have to pay for your policy. Read more…

Insurance bonds (a.k.a. surety bonds) are either continuous or renewable. How do you tell the difference between the two? Read more…

Crystal Ignatowski is a Marketing Content Developer. She writes and creates content for Surety Solutions, A Gallagher Company's blog and website.

Secured by SSL.

Email: customercare@suretysolutions.com

4285 Commercial Street SE

Suite 110

Salem, OR 97302

(866) 722-9239

Please read our Privacy Policy and Terms & Conditions.

I bought carfrom Liv’s Used Auto cars in Georgia they said they would mail me the title in 3 weeks out about it may the 1st 2022 I have not yet received the title it is now the end of August and the dealership was selling cars without license I have a police report which was a video cam did the whole investigation and videoed it on June the 9th 2022 I had to go back to Georgia the car was not in good condition like they had it advertised they have done fraud on to the odometer reading they had it fit in their name on 4122 and was sent to their address and they’re telling me they’re looking for the title they’re getting the title the titles being mailed I had to have about $2,000 or over and repairs on the car because they advertised it as $130,000 Mi nothing wrong with it good reliable dependable car and I’ve had to get the serpentine belt the wires were messed up I had to get them fixed the power steering is leaking it can cause the car to catch on fire and bust the wheel bearings were coming out I had to get that fixed also had to get four new tires because the tires on it we’re peeling off they were bad I need some help I have made complaints on top of complaint and I cannot find out their security bond company he will not tell me how can I find out who was being there security Bond so I can make a complaint I have not yet received the title I do have a bill of sale I live in South Carolina they have fraud charges already for scamming people I have the paperwork how can I do something about this and get my title and get my money recovered back from what I’ve had to put into the car they have like five different businesses but lives Used Auto cars was not licensed to sell cars and that’s where I bought the car from was Liv’s Used Auto in Lawrenceville Georgia they charged me taxes and tags for Georgia and I live in South Carolina I cannot get no help can someone please help me or tell me who I can hire or how to complaint get their bond so I can file a complaint I need help can someone please help me

Hello Tina,

I am sorry to hear you had a bad experience with a vehicle dealer. If you wish to file a complaint, we have a helpful blog post on the process of filing a complaint against vehicle dealers here: https://suretysolutions.com/suretynews/take-control-how-to-file-a-complaint-against-a-car-dealer/

Since the vehicle dealer’s business is in Georgia, we recommend you contact the Georgia Consumer Protection Unit to file your complaint: https://consumer.georgia.gov/resolve-your-dispute/how-do-i-file-complaint

We hope your situation quickly gets resolved with the vehicle dealer. Best of luck!

Comments are closed.