If you bought a car with no title, or if you are the victim of title-jumping, you might be able to get a Bonded Title. Bonded Titles can be confusing, so we made this list of frequently asked questions.

Don’t see your question listed here? Leave us a comment in the comment section!

Not sure if you need a Bonded Title? Check out this awesome infographic.

A: A Bonded Title is a regular certificate of title that is marked “bonded”. Maybe you have heard of a salvage title or a rebuilt title. Those are titles that have a title brand.

A Bonded Title is just a title with a “bonded” brand.

A Bonded Title signifies the title has a surety bond attached to it. You can learn what it means to have a bonded title further in the article.

A: Not really. The only difference between a Bonded Title and a regular title is that a Bonded Title is branded ‘bonded’. A Bonded Title and a regular title function exactly the same and allow you to register, insure and sell your vehicle.

The ‘bonded’ brand can be removed from your title usually within 3-5 years (depending on the state you live in).

The 3-5 year time period starts from the date the original bonded title was issued. It does not start over if the title is transferred into someone else’s name.

Once the 3-5 year period ends, it is the responsibility of the current title owner to go to the DMV and apply for a clean title.

A: Your local DMV is the only entity that can tell you if you are eligible for a Bonded Title. If you are wondering if you can get a Bonded Title, contact your local DMV and ask if you would be eligible.

Anyone can buy a Lost Title Bond, but if the DMV doesn’t accept it from you, you will be stuck with something you can’t use.

For reasons when you might need a bonded title, please see our “4 Reasons You Might Need a Bonded Title” post.

A: When you purchase a Lost Title Bond, the surety company will mail it to you.

Then you take the bond to the DMV. After that, the amount of time it takes the DMV to issue you a Bonded Title depends on their processes and how fast they get your paperwork approved. It could take as little as 1 week or as long as 4 weeks.

A: Essentially, the process is this: you purchase a bond, we mail you the bond, you take the bond to the DMV, and the DMV issues you the Bonded Title. There might be other steps involved like getting your vehicle inspected and completing other paperwork.

When you get the bond, you are promising that you are the true owner the vehicle. The bond is in place to protect the DMV and any previous owners of the vehicle.

If someone comes forward later on and says that they are the owner of the vehicle and that you should not have been granted a Bonded Title, they can make a claim on your bond.

If the claim is determined to be valid, you would be responsible for satisfying the claim. This is your obligation under the bond. Usually, this would mean a financial compensation. The surety company would determine what is fair.

If you fail to satisfy the claim, the surety company would satisfy the claim for you. Then, they would come to you for reimbursement. Essentially, the bond holds you liable for your actions, no matter what.

Curious about what would happen if someone made a claim on your bond? Check out this resource.

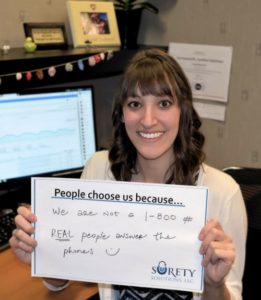

About Surety Solutions, A Gallagher Company

Surety Solutions makes the process of getting your surety bond quick and easy. We’re committed to uphold our culture of trust, honesty and great customer service.

Do you need a Bonded Title?

Follow our simple infographic to see if getting a Bonded Title is the best option to register your vehicle.

Related Articles

If you bought a car without a title or were title-jumped, getting a Bonded Title might be your best solution. Read more…

The cost of the lost title bond is significantly less than the bond amount. Read more…

Avoid making these mistakes when getting your Bonded Title. Read more…

If a Vehicle Dealer did not provide a title or other paperwork to register your vehicle, you may want to file a complaint. Read more…

A: Every state will be different, but generally will require you to complete a title application, purchase a lost title bond and pay a titling fee. For step-by-step tutorials on how to get a Bonded Title, check out our Bonded Title Resource Page or just click on your state below:

A: Unlike other surety bonds whose rates are based on credit, lost title surety bonds are based on the value of the vehicle. Most states require your lost title bond to be in the amount of 1.5 or 2 times the value of your vehicle, but don’t worry, this is not the amount you have to pay for your bond.

Not sure how much your bond amount should be? Use this interactive tool to help you out:

A: The price you pay for your lost title surety bond will depend on your total bond amount.

Most people only need to pay $100 for their bond.

You can apply online, anytime, any place and get approved for your lost title bond instantly.

A: Most states do require a vehicle inspection before you can be issued a Bonded Title.

The vehicle inspection is normally done by a registered vehicle inspector or a law enforcement officer.

Vehicle inspections are necessary to establish that your vehicle is not stolen.

A: Most states will allow you to get a Bonded Title, but there are a few states that will not.

Ohio, for example, does not have a Bonded Title option, but you can get an Ohio court-ordered title instead.

Indiana also has a court-ordered title process.

To see if your state allows for a Bonded Title, check out our Bonded Title Resource Page

A: You’ll want to check with both states to see how to proceed with getting a Bonded Title.

Normally, if you are residing in a state, but your vehicle is from out-of-state, the DMV will need to inspect your vehicle and supply you with a Vehicle Inspection Certification before you can continue applying for your Bonded Title.

A: If you have a Bonded Title and you move to a new state that allows for bonded titles, you shouldn’t have any trouble registering your vehicle in the new state.

There are cases, though, where if you are moving to a state that does not allow for bonded titles, you might have difficulty. Check with both your local DMV from your current state and the state you are moving to so you can confirm if a title transfer would be possible.

A: There are various types of title brands including salvage, rebuilt, lemon, etc. Check with your local DMV on whether you can get a bonded title, and if there are different steps involved in the process if the last title was marked with a title brand.

In the case of Certificate of Destructions, that is a type of title normally issued for water-damaged vehicles whose power, train, computer or electrical system has been damaged by flooding, and the vehicle has been deemed a total loss. Usually, in these cases, the vehicle can never be titled again.

A: Normally, you can only apply for a Bonded Title on a vehicle that is rightfully yours. If you are in a situation where a vehicle has been abandoned on your property, view this guide on “How to get the Title to an Abandoned Car”

A: Usually no. If there is a lien on your vehicle, the lien holder is the legal owner.

When you pay off a loan in full, lien holders usually send the DMV everything needed to remove their name from the vehicle.

If you purchased a vehicle from someone and didn’t realize there was a lien on it, you’ll need to have the lien removed by either:

A: If you bought a vehicle from a personal bankruptcy sale, you can apply for a regular title and registration at any DMV. You will need to provide certain documents, which will vary by state, but will most likely include:

A: If a decedent has left a will, the executor of the estate may transfer the title to you by providing the following documents to the DMV:

If the decedent has not left a will, the court appointed administrator may transfer the title to you by providing the following documents to the DMV:

Crystal Ignatowski is a Marketing Content Developer. She writes and creates content for Surety Solutions, A Gallagher Company's blog and website.

Secured by SSL.

Email: customercare@suretysolutions.com

4285 Commercial Street SE

Suite 110

Salem, OR 97302

(866) 722-9239