Do you have a car in Wisconsin, but no title? Maybe you recently bought a car, but never received the title. Or maybe you received the title, but lost it before transferring it into your name? Sounds like you need a Wisconsin Bonded Title.

Short on time? Check out our Bonded Title FAQ page.

What is a Wisconsin Bonded Title?

A Wisconsin Bonded Title is a document that proves you own your vehicle.

A bonded title is just like a regular title, except in the title brand section, it says “Bonded”. The “bonded” brand implies there is a surety bond attached to the title.

The “bonded” brand can be removed from the title after 5 years. (More about this at the end of the blog post.)

Why do I need a surety bond?

When you get a bonded title, you are promising that you are the true owner of the vehicle.

If someone comes forward later on and says that they are the owner of the vehicle and that you should not have been granted a bonded title, they can make a claim on your bond. If the claim is determined to be valid, the surety company would pay the person a fair amount. It would then be your responsibility to repay the surety company.

If you are the true owner of the vehicle, you should not be concerned about any bond claims.

When You Might Need a Wisconsin Bonded Title

You might need a bonded title in any of the following situations, though this is not a complete list. You also should always check with your local DMV on if you can get a bonded title before starting the process.

- You bought a vehicle and didn’t receive a title

- You bought a vehicle and only received a bill of sale

- You bought a vehicle and received an improperly assigned title

- You bought a vehicle, received the original title, but lost it before transferring it into your name*

*If you had the original title registered in your name at one point in time, you do not need a Bonded Title. You can just get a duplicate/replacement title.

You can apply for a duplicate WI title certificate online, by mail, or in person at your local WI Department of Motor Vehicles office. There is a $20 replacement title fee.

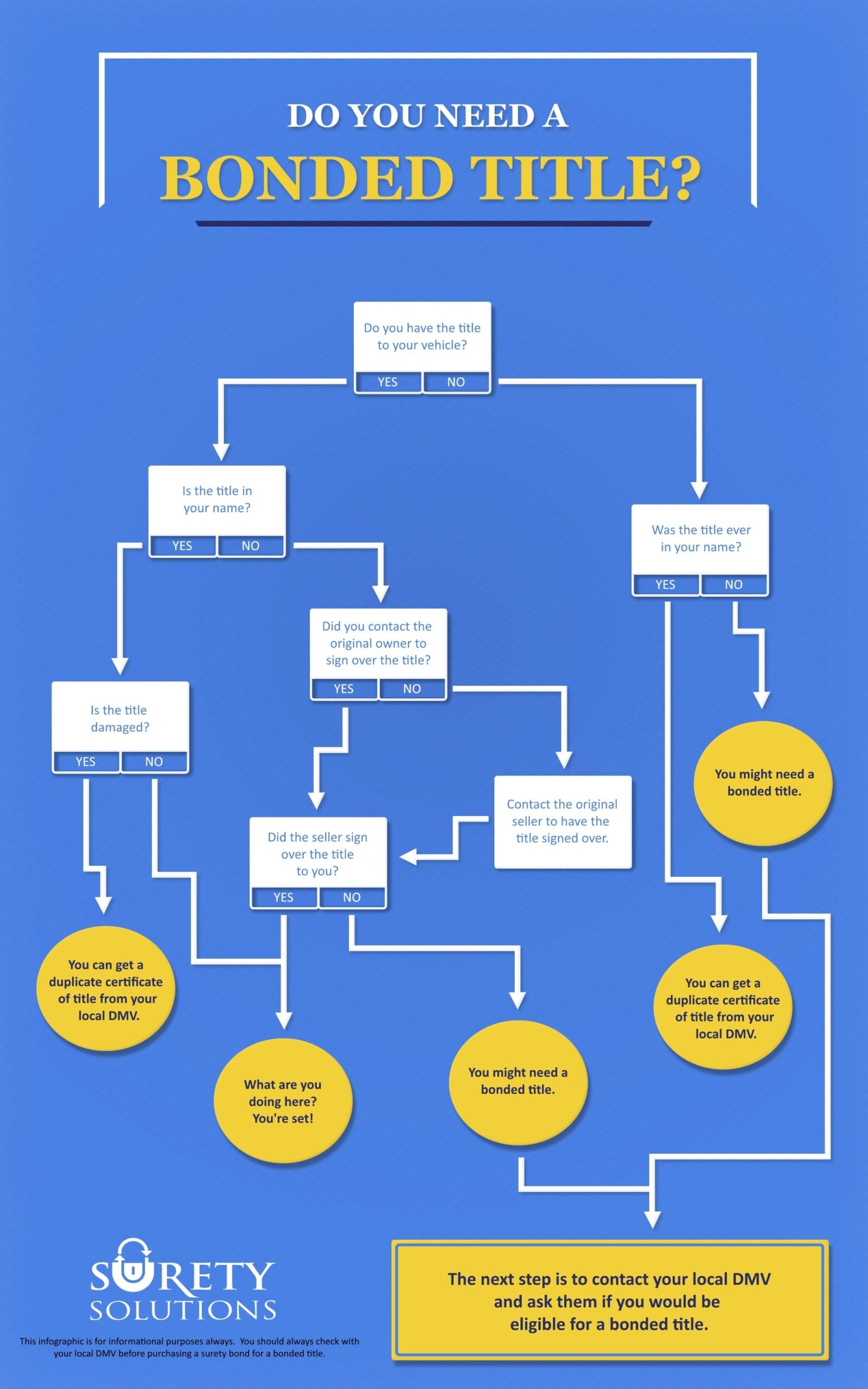

Not sure if you need a WI Bonded Title? Check out this awesome infographic.

How to get a Wisconsin Bonded Title

Step #1: Contact DMV to make sure you are eligible

Your local DMV is the only entity that can tell you if you are eligible for a bonded title or not.

Contact your local DMV, explain your situation, and ask if you could get a bonded title.

If they say yes, move on to Step #2.

Step #2: Complete Paperwork

- Download and complete Wisconsin Application for Bonded Title

- Download and complete Wisconsin Title & License Plate Application

- Include any bill of sale/previous title paperwork if you have it

Step #3: Submit photographs

Submit photographs of vehicle (front, rear, side views, and VIN number). If you do not have a clear shot of the VIN, include the Public Vehicle Identification Number Certification form (to be completed by law enforcement.)

Step #4: Send paperwork to the address below:

Vehicle Records Section – Research & Information Unit

Wisconsin Department of Transportation

PO Box 8070

Madison, WI 53708-8070

The Wisconsin Department of Transportation (WisDOT) will look over your WI Bonded Title application and make sure it is complete and your vehicle meets the requirements to be bonded.

For information on what happens next, view Step #2 of the Instructions for Bonded Title.

If your vehicle can be bonded, WisDOT will send you a letter requesting you to secure a Wisconsin Lost Title Bond. You can now move on to Step #5.

Step #5: Purchase a Wisconsin Lost Title Bond

Purchase a Wisconsin Lost Title Bond from a surety bond company. Make sure you apply for the correct bond amount.

If you do not apply for the correct bond amount, your bond might be rejected by the DMV.

The bond amount for your WI Lost Title Bond must be for one and a half times the appraised value of the vehicle. WisDOT should provide you with a bond amount in your approval letter. The minimum bond amount is $2,500. Don’t worry though, this is not how much you have to pay for your bond.

You do not have to pay the full amount of your bond to get bonded.

Surety Solutions, A Gallagher Company does not issue Certificate of Lost Title Bonds

Before you purchase your title bond – learn important payment info

After you purchase your bond, the surety bond company will mail it to you.

Step #6: Send Wisconsin Lost Title Bond to WisDOT

Send your original bond to WisDOT.

Once WisDOT receives your Wisconsin Lost Title Bond, they will issue you a Wisconsin Bonded Title.

For more help, view Wisconsin’s Bonded Title FAQ page.

What it Means to be Bonded

When you get a bonded title, you are promising that you are the true owner of the vehicle and that you will take responsibility for any bond claims.

If someone comes forward later on and says that they are the owner of the vehicle and that you should not have been granted a bonded title, they can make a claim on your bond.

If the claim is determined to be valid, you would be responsible for satisfying the claim. Usually, this would mean a financial compensation. The surety company would determine what is fair.

If you fail to satisfy the claim, the surety company would satisfy the claim for you. Then, they would come to you for reimbursement. Essentially, the bond holds you liable for your actions, no matter what.

Want more information about what happens if someone made a claim on your bond? Check out this resource.

Do Wisconsin Bonded Titles Expire?

Yes. WI Bonded Titles expire 5 years after the date they are issued.

If during those 5 years no one comes forward and makes a claim against your WI Lost Title Bond (stating they are the true owner the vehicle), you have the option to go the DMV and apply for the “bonded” brand to be removed from your title. If approved, you could be issued a clear certificate of title.

If you decide to sell your vehicle before the 5 years is up, that is okay. Your name will remain on the surety bond, though, until the 5 years is up. You will be liable for any surety bond claims during those 5 years.

Related Links: