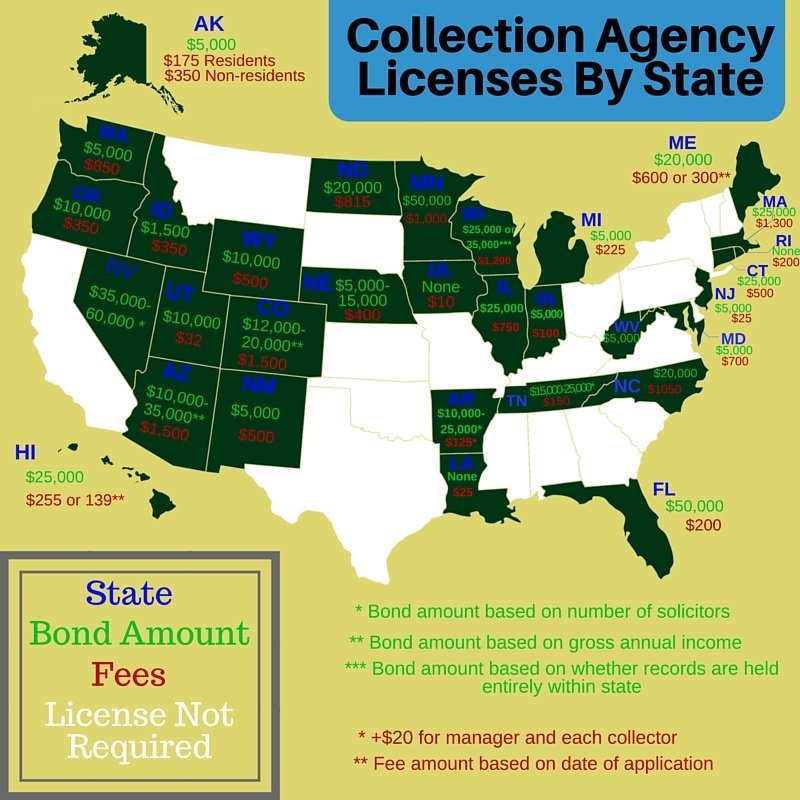

If you are planning on collecting money in the state of Oregon you are going to need to make sure you get licensed first.

Applying for Your License

Step #1: Complete your application

Step #2: Pay a $350 application fee

Step #3: Purchase a $10,000 surety bond

Step #4: Create a list of all branches you will have in Oregon collecting money

What is a Collection Agency Bond?

Collection Agency Bonds (sometimes called Debt Collector Bonds) connect you, your state government agency, and a surety company into a contractual agreement.

A Collection Agency Bond holds your business to a high standard and promises your clients that you will conduct ethical and honest services. This includes appropriately handling money and appropriately processing any fees that incur during a business transaction.

Should you not run an ethical business, your clients are protected by the bond and have a plan of action to recover any financial losses that might come about.

How Much Will my Bond Cost?

The amount of a collection agency bond in Oregon is $10,000, luckily, that is not how much you will need to pay to get your bond. The actual price you pay is a small percentage of that amount which is determined by your credit score. This percentage is usually between 1-15%.

At Surety Solutions, we know getting bonded can be expensive. That’s why we developed an online Bond Cost Calculator that lets you view quotes for your bond so you can compare prices before you buy. We have relationships with over 30 of the top insurance carriers in the nation and are licensed in all 50 states, which means we can not only get you bonded but at the best and lowest price. Curious about what you would pay for your Collection Agency Bond? Your free quotes are just a click away.

Free Oregon Collection Agency Bond Quotes!

Related Post: