Collection agencies are often seen as high risk. Due to the fact that they handle sensitive client information, collection agencies are often required to get a Collection Agency Bond before the state will issue a license.

What is a Collection Agency Bond?

A Collection Agency Bond (sometimes called a Debt Collector Bond) is a type of surety bond that promises you will follow rules and regulations of your professional license. Your bond also promises you will indemnify the surety company if they pay out on a bond claim.

The Bond Claim Process

A bond claim is a complaint saying that you have not fulfilled the duties of your license. Anyone can make a claim against your bond. Generally, the claim cannot be for more than the total amount of the bond. Someone might make a claim against your bond for any of the following reasons:

- Fraud

- Theft

- Discrimination

- Overcharging customers, misusing their money, or manipulating your fees for your benefit

Claims can only be made against your bond during the time your bond is active.

If a claim is filed against your bond, the surety company expects you to take care of the claim. If you fail to do this, the Surety will usually start an investigation to determine the claim’s validity. They will reach out to both you and the claimant.

One of two things will happen:

- The surety company will investigate the claim and determine it to be invalid. No further action will be taken with the investigation, but you might be liable for any costs the Surety incurred during the investigation process.

- The surety company will investigate the claim and determine it to be valid.

If the surety company finds the claim to be valid, they will remind you of your obligations under the bond and ask you to settle the claim. Usually this involves compensating the claimant for any financial loss or damages incurred.

If you fulfill the claim, the claim process ends.

If you fail to fulfill the claim, the surety company will step in and pay the claim for you. The surety company will then come to you for reimbursement of the settlement and any legal costs associated with it.

This is one way a surety bond differs from an insurance policy. While an insurance company does not expect to be paid back for a claim, a surety company does. You are responsible for cooperating with the surety company during the entire claim process. You are also responsible for paying back the surety company every penny they pay out on a claim, including all costs associated with the claim.

You can learn more about the bond claim process here.

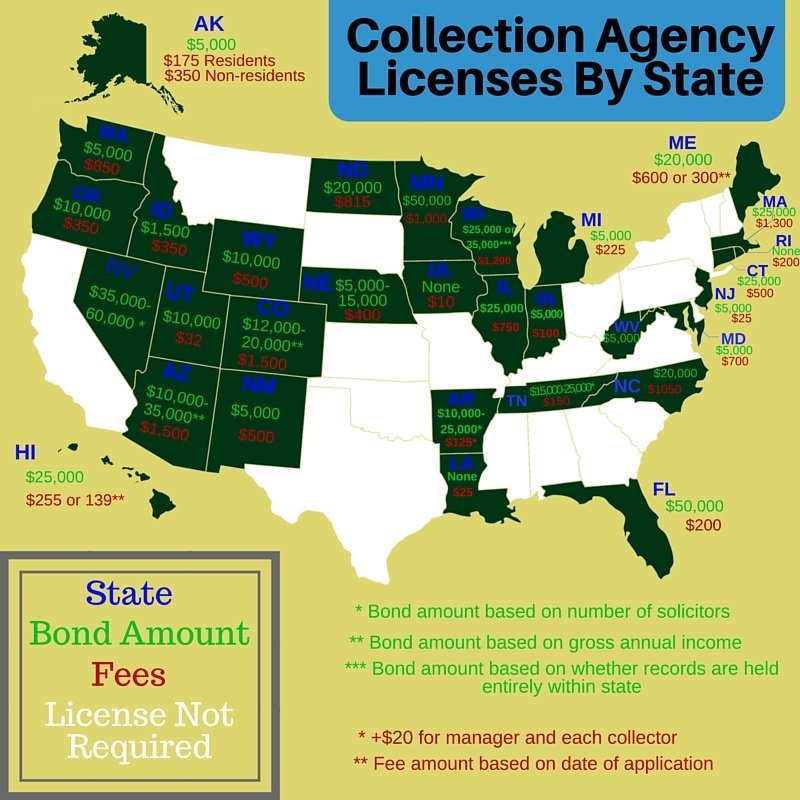

Which States Require Collection Agency Bonds?

Many states require collection agencies to get bonded. Some states do not, though.

The following states have a bond requirement:

- Alaska – $5,000 bond

- Arizona – $10,000 – $35,000 bond (based on gross annual income)

- Arkansas – $10,000 – $25,000 bond (based on number of solicitors)

- Colorado – $12,000 – $20,000 bond (based on gross annual income)

- Connecticut – $25,000 bond

- Florida – $50,000 bond

- Hawaii – $25,000 bond

- Idaho – $1,500 bond

- Illinois – $25,000 bond

- Indiana – $5,000 bond

- Maine – $20,000 bond

- Maryland – $5,000 bond

- Massachusetts – $25,000 bond

- Michigan – $5,000 bond

- Minnesota – $50,000 bond

- Nebraska – $5,000 – $15,000 bond

- Nevada – $35,000 – $60,000 bond (based on number of solicitors)

- New Jersey – $5,000 bond

- New Mexico – $5,000 bond

- New York City of Buffalo – $5,000 bond

- North Carolina – $20,000 bond

- Oregon – $10,000 bond

- Tennessee – $15,000 – $25,000 bond (based on number of solicitors)

- Texas – $10,000 bond

- Utah – $10,000 bond

- Washington – $5,000 bond

- West Virginia – $5,000 bond

- Wisconsin – $25,000 – $35,000 (based on whether records are held entirely within state)

- Wyoming – $10,000 bond

This map depicts what states have a bond requirement, and which ones do not.*

*Bond amounts and license requirements are subject to change. This map is for informational purposes only and does not represent legal advice. Always check with the licensing authority to ensure you have the correct requirements for your specific situation.

How Much Does a Collection Agency Bond Cost?

Collection Agency bond amounts vary by state. Some states only require your company to get a $10,000 bond, while other states require a larger bond amount.

You do not have to pay the full bond amount to get bonded. You will pay anywhere from 1-15% of the total bond amount. The rate you pay is largely based on your credit score.

The best way to see what you’d pay for a Collection Agency Bond is to get a free quote.

We’ve issued bonds for as low as $100.

Free Collection Agency Bond Quotes

Getting a Collection Agency Bond with Bad Credit

You can still get bonded with bad credit.

At Surety Solutions, we have bad credit options for individuals. We can work with you, regardless of your situation.

Will My Bond Work in all 50 States?

No. Surety bonds are only valid for the state they are issued for. For example, an Oregon Collection Agency Bond is only valid in Oregon, and a Colorado Collection Agency Bond is only valid in Colorado.

If you want to work in multiple states, you will have to furnish individual bonds for those states. Many surety companies will have bulk underwriting programs which will help you get bonded in multiple states without reaching your surety credit limit.

Related links: