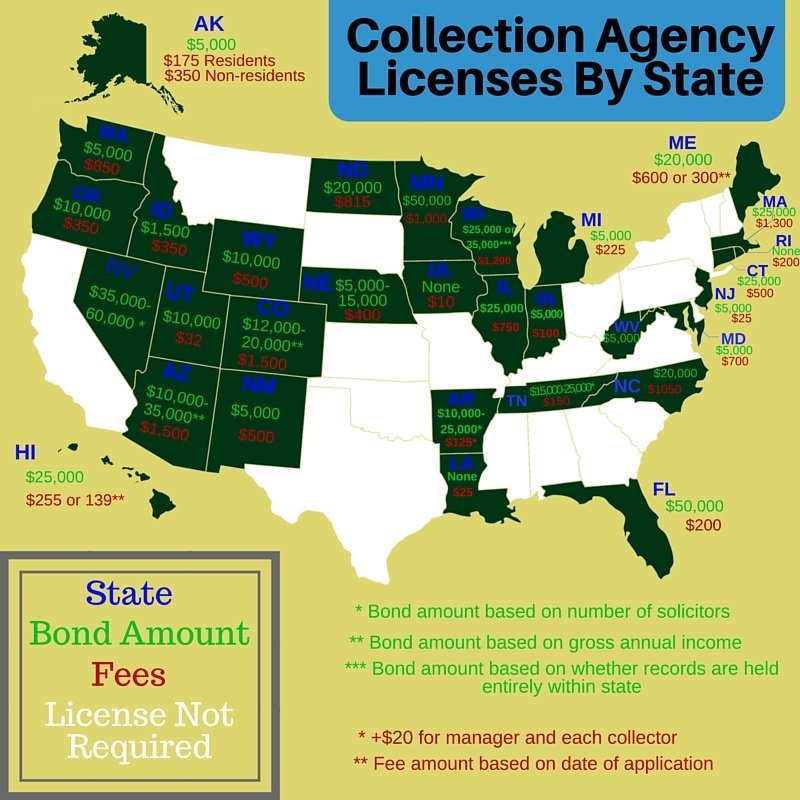

Anyone in the state of Florida that is soliciting debts from consumers needs to get a Florida Collection Agency License before they can legally start conducting business. The Florida Office of Financial Regulation handles all the licensing.

How to get a Florida Collection Agency License

Step #1: Determine what license you’ll need

There are two main license types:

- Commercial Collection Agency License – allows the holder of the license to collect or solicit collection for commercial claims, asserted to be owed or due to another person, including third party collectors of debts made by commercial businesses.

- Consumer Collection Agency License – allows the holder of the license to collect or attempt to collect consumer debts, asserted to be owed or due to another person, including third party collectors of debts made by individual consumers.

Apply online for your license by clicking on one of the above links, or by starting on the Florida Office of Financial Regulation license service web page.

Step #2: Pay licensing fee

The licensing fee for a Commercial Collection Agency License is $500.

The licensing fee for a Consumer Collection Agency License is $200.

You can pay the fee electronically during your application.

Step #3: Purchase a Florida Collection Agency Bond

A Collection Agency Bond is a type of surety bond that that promises you will follow rules and regulations of your professional license. Your bond also promises you will indemnify the surety company if they pay out on a bond claim.

You can learn more about how the surety bond works at the end of the article, or on our Collection Agency Bond blog post.

Contact a surety bond agent to get a Collection Agency Bond. Florida has set the bond amount at $50,000, but this is not how much you have to pay for your bond.

Depending on your credit score, you will pay anywhere from 1-15% of the bond amount. This would be a one-time payment, not monthly. You would not need to pay for your bond again until you need to renew your license.

To see what you’d pay for a Florida Collection Agency Bond, get a free quote below:

Get free Collection Agency Bond quotes

Step #4: Submit a background check and fingerprints

You will need to submit a background check and fingerprints before you can be approved for your license. You can do this all electronically.

The cost of fingerprint processing, including the cost of retaining the fingerprints, will need to be paid for by you, the applicant.

If you have a felony on your record, you are not automatically disqualified, but it is ground for denial. Learn more in Section 5 of the Registration of Consumer Collection Agencies.

Step #5: Submit paperwork

Submit your original bond to the Office of Financial Regulation.

Make sure you have submitted and met all requirements by checking the checklist:

Your license will be valid until December 31 of each year. You can learn more about the license expiration and renewal at the end of the article.

What is a Florida Collection Agency Bond?

A Florida Collection Agency Bond (sometimes called a Debt Collector Bond) is a type of surety bond that promises you will follow rules and regulations of your professional license. Your bond also promises you will indemnify the surety company if they pay out on a bond claim.

The Bond Claim Process

A bond claim is a complaint saying that you have not fulfilled the duties of your license. Anyone can make a claim against your bond. Generally, the claim cannot be for more than the total amount of the bond. So, in Florida, generally the claim cannot be for more than $50,000. Someone might make a claim against your bond for any of the following reasons:

- Fraud

- Theft

- Discrimination

- Overcharging customers, misusing their money, or manipulating your fees for your benefit

Claims can only be made against your bond during the time your bond is active.

If a claim is filed against your bond, the surety company expects you to take care of the claim. You can learn more about the bond claim process and what happens if you fail to satisfy the claim here.

License Expiration and Renewal

Licenses are valid for one year and must be renewed annually for you to remain compliant with the law.

Renewals should take place between October 1 and December 31 of each year. You can learn more about Renewing on the Commercial Collection Agency or Consumer Collection Agency page.

Related links: