This post originally appeared on Quora. Check it out here: “What is the Difference Between a Surety Bond and Security Deposit?”

Put simply, a surety bond is an alternative to a security deposit. Here’s what you need to know.

Please note: Currently, we (Surety Solutions, A Gallagher Company) do not offer these bonds, but we know of a company who does: Get Your Bond Through SureDeposit

Let’s say you are renting an apartment and your landlord gives you the following options for payment before you can move in:

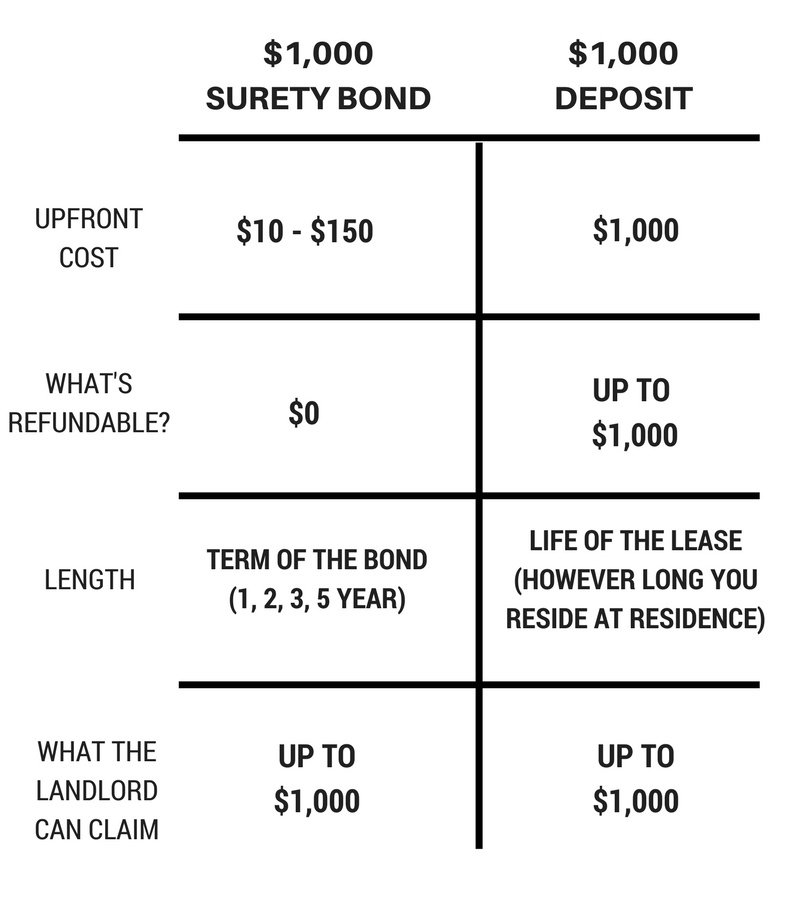

A security deposit is a set-amount of money ($1,000) that you pay the landlord before you move in. This set-amount of money ($1,000) serves to protect the landlord if you violate terms of the lease, trash the property, etc. If the security deposit is refundable, you could get it back (all the way up to $1,000) once you move out as long as the rental is undamaged and you have paid all your rent, etc.

A surety bond is a three-party agreement that binds you, a surety company and your landlord together. Basically, getting a surety bond is kind of like having a surety company co-sign for you. Generally, you’ll pay 1-4% of the total bond amount (so $10-$40). If you violate the terms of the lease, trash the rental, etc, then your landlord can make a claim against your bond. If the claim is determined to be valid, the surety company will pay your landlord (up to $1,000). Then the surety company will come to you for re-payment for whatever they paid your landlord.

One important difference is that with a security deposit, you can get the money back (up to the full $1,000 or whatever the amount is). With a surety bond, you cannot get back the money you paid for it (the $10-$40). That money is non-refundable. And, if your landlord makes a claim against your bond, you might be forced to pay the total bond amount.

Both are forms of protection for your landlord, but one might cost you more money in the end.

Surety bonds and security deposits accomplish the same thing, but there are drawbacks you need to weigh.

Still need more help? Check out this resource.

*Most surety companies will have a minimum charge for any bond they issue. Many companies have a minimum $100 charge.

Are you a resident looking to get a bond in place of a security deposit? Are you a landlord wanting to allow the option for a surety bond for new residents moving in?

Please note: Currently, we (Surety Solutions, A Gallagher Company) do not offer these bonds, but we know of a company who does: Get Your Bond Through SureDeposit

About Surety Solutions, A Gallagher Company

Surety Solutions makes the process of getting your surety bond quick and easy. We’re committed to uphold our culture of trust, honesty and great customer service.

Get quotes for your Surety Bond

Need a bond? Get free quotes from top surety companies.

Related Articles

A Surety Bond is a written three-party contract in which the surety and the principal become obligated to the obligee for the payment of a sum of money if the obligation set forth in the bond is not fulfilled by the principal. Read more…

While it’s a common occurrence for people to confuse surety bonds with traditional insurance policies, they both function differently. Read more…

What do you do if someone makes a claim against your bond? Learn how the claim process for surety bonds works. Read more…

While searching for a surety bond, ensure the surety company you agree to work with is able to deliver on their services. Read more…

While often being compared to insurance policies, one big difference with surety bonds is how often you have to pay for your policy. Read more…

Crystal Ignatowski is a Marketing Content Developer. She writes and creates content for Surety Solutions, A Gallagher Company's blog and website.

Secured by SSL.

Email: customercare@suretysolutions.com

4285 Commercial Street SE

Suite 110

Salem, OR 97302

(866) 722-9239