This post originally appeared on Quora. View the post.

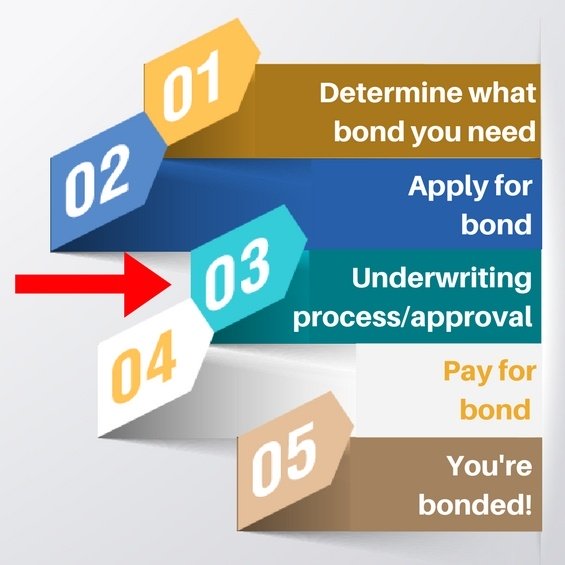

When you apply for a surety bond, you might be approved instantly. But, some bonds require a underwriter to review your information. This is known as surety bond underwriting.

Find out what surety bond underwriting is, how it affects your bondability, and what it means for the cost of your surety bond.

What is Surety Bond Underwriting?

Surety bond underwriting is risk evaluation.

Underwriting itself is the process of researching and assessing the risk of applicants.

An underwriter is the individual who performs the underwriting. Underwriters are presumed as professionals in their field. Their job is to determine the background and experience of the individual applying for a bond, therefore determining the risk of bonding him/her.

For a more in-depth look at the underwriter’s role in issuing a surety bond, view the article “Surety Underwriting, Sales, and Service – A Delicate Balance”.

What Underwriters Will Evaluate?

So what will an underwriter evaluate? Everything? Well, not quite.

Common underwriting factors for surety bonds include:

You – the applicant

- Do you have the skills and ability to complete the bond obligation?

- How is your financial condition? Does it make sense to approve you for this bond based on your credit score/financial history? – link

- How is your experience? Have you ever had a license suspended? Do you have pending lawsuits? Unpaid child support?

Risk Factors of the bond

- Hazardous bond types

- Length of the surety bond obligation

Every surety bond will have its own underwriting process. You might need to submit only an application, or you might need to submit more like financial statements and/or other documents.

In short, underwriting happens so the surety company can evaluate/assess the risk to bond you. Underwriting also determines how much you might pay for your surety bond, if approved.

Want a teaser on pricing? View this post on “How Much Does a Surety Bond Cost?”

For more information on what an underwriter is thinking when evaluating you, view “Inside the Mind of a Surety Bond Underwriter.”

Surety Underwriting – The Goal Is Zero Losses

Traditionally, surety bonds are underwritten to have a zero percent loss ratio. Another way to say this is that underwriters are only supposed to approve applicants if they believe there will be no claims on the applicant’s surety bond.

Insurance underwriting, on the other hand, does account for losses. This is why it is sometimes harder to get a surety bond: with a zero loss ratio, surety companies and underwriters only want to write bonds for top applicants.

Don’t be concerned if you feel you are not a “top applicant”. Many sureties have developed into more diverse companies that can offer surety bonds for applicants that have bad credit, convictions, or colorful histories.

Worried about bad credit? Check out this post.

Now that you are aware of what will happen after you apply for a surety bond, it’s time to apply.

Get a free surety bond quote below.

Related Links:

Surety Underwriting, Sales, and Service – A Delicate Balance