You like to have a feeling of certainty about your decisions. How do you know if it’s worthwhile to get a surety bond? Surety bonds are all about that certainty — a way to build trust between your company and your clients.

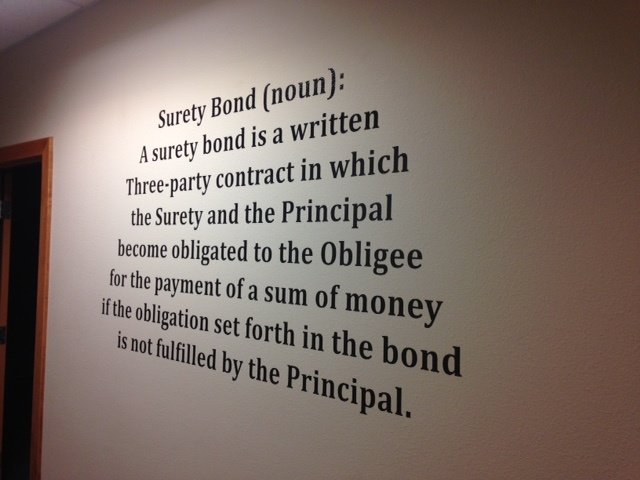

What is a Surety Bond?

A surety bond is a relationship between a company, a client, and a surety bond provider. If things go awry and the company cannot fulfill its obligations to the client, then the surety bond company will step in to help the client.

Surety bonds are different from insurance. Insurance protects the person who holds the policty. A surety bond does not protect the person who holds the surety bond. Rather, a surety bond protects the clients of the one who has the surety bond. You can learn more about the differences between surety and insurance.

Not sure if you need a surety bond? Check out this post: 4 Reasons You Might Need a Surety Bond.