We’re always greeted with a large wall of text when installing new applications or software on our computers and phones. How often do you find yourself scrolling to the bottom of these terms-of-agreement popups to quickly find and click the “accept” button? Who has the time to read these agreements when they are so frequent? However, when given a contract related to work, insurance or legal proceedings, such as a surety bond, do you carefully read these documents before putting pen to paper? Or, are you guilty of simply skimming the text as you would with installing a new app?

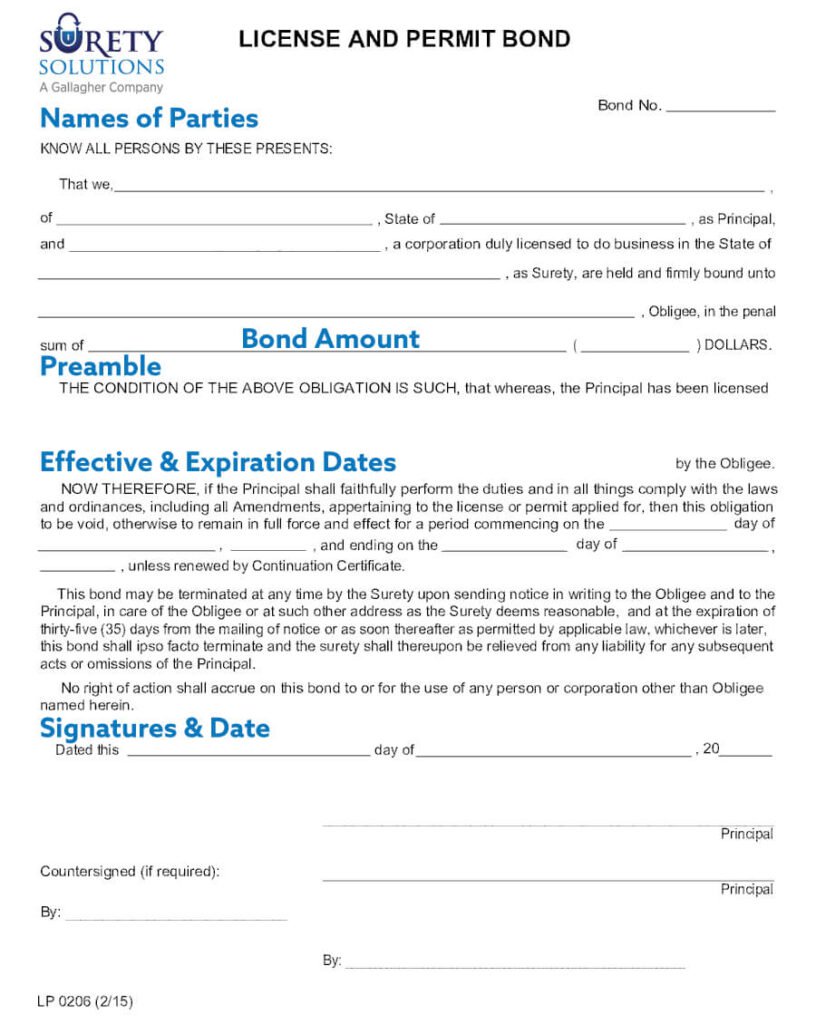

When you purchase a surety bond, most of the blank fields auto-populate with the information you provide on your application. Leaving just the date and signatures of the involved parties to be filled out. And possibly a notary, if required on the bond form. However, even though the bond form is prepared to be signed, reviewing the bond first is beneficial for you to understand the agreement you’re making.

A surety bond serves as a contract between you (the principal), the surety and the entity requiring you to purchase the bond (the obligee). By reviewing the bond form, you’ll understand your responsibilities you are agreeing to uphold and the consequences you’ll face should you receive a valid claim against your bond.

Let’s review a general contractor license/permit surety bond form as an example. On the top portion of the bond, we fill out the names of the three parties involved, along with the state and the dollar amount of coverage the bond provides.

The next section is the preamble, which is the introduction portion of the bond. Here, you’ll find an explanation of the bond’s purpose and which state or local statutes enforce this bond requirement. As the principal, you must follow the rules and regulations set by the state or municipality’s licensing department. If you fail to honor the contract agreement with the obligee, a claim can be made against your bond to collect financial reimbursement not exceeding the total bond amount in coverage.

In the event of a claim, the surety conducts an investigation to determine its validity. If found valid, the surety will payout to the claimant with the expectation of you making them financially whole. The surety will not payout more than the specified bond amount, even if the claim or multiple claims exceed this amount. Due to bond amounts being inadequate over time, new bills are created to increase the size of the required bond amount.

The length of your bond’s term is also set in the preamble. A bond is active between the effective and expiration dates, written out in this section. Most bond types have an effective date of one year, but they can be set at two or more years. However, do note that the bond amount doesn’t stack over the years. On the third year of being active, a bond with coverage set at $2,000 will not pay out $6,000. The number of years a bond has been active does not change the amount the surety company pays out on a claim.

At the bottom of the bond form is where you and the surety date and sign the document. And possibly a notary signature, if required on the form. Sometimes, an indemnity agreement is necessary to review and sign before you can sign your bond form. This additional contract holds the surety harmless for any burden, damage or loss and ensures compensation is accessible if such damage or loss occurs.

By understanding your responsibilities outlined on the surety bond form, you can confidently sign the agreement. Although both you and the surety don’t expect to deal with a claim, they do happen. Knowing what you’re responsible for after a valid claim is made against your bond is important. As the principal, you are responsible for making the surety financially whole if they have to pay out on a valid claim.

If you have any questions about surety bonds or your bond form, contact our surety experts by emailing info@suretysolutions.com or call (866) 722-9239. We look forward to issuing your surety bond.

About Surety Solutions, A Gallagher Company

Surety Solutions makes the process of getting your surety bond quick and easy. We’re committed to uphold our culture of trust, honesty and great customer service.

Get quotes for your Surety Bond

Need a bond? Get free quotes from top surety companies.

Related Articles

Insurance bonds (a.k.a. surety bonds) are either continuous or renewable. How do you tell the difference between the two? Read more…

You don’t expect to have a claim. But, if someone does make a claim against your bond, what happens? Read more…

While often being compared to insurance policies, one big difference with surety bonds is how often you have to pay for your policy. Read more…

Beau is the Marketing Content Developer at Surety Solutions, A Gallagher Company. He creates content about all types of surety bonds, including mortgage, court, lost title, contractor, fidelity, ERISA and many more.

Secured by SSL.

Email: customercare@suretysolutions.com

4285 Commercial Street SE

Suite 110

Salem, OR 97302

(866) 722-9239