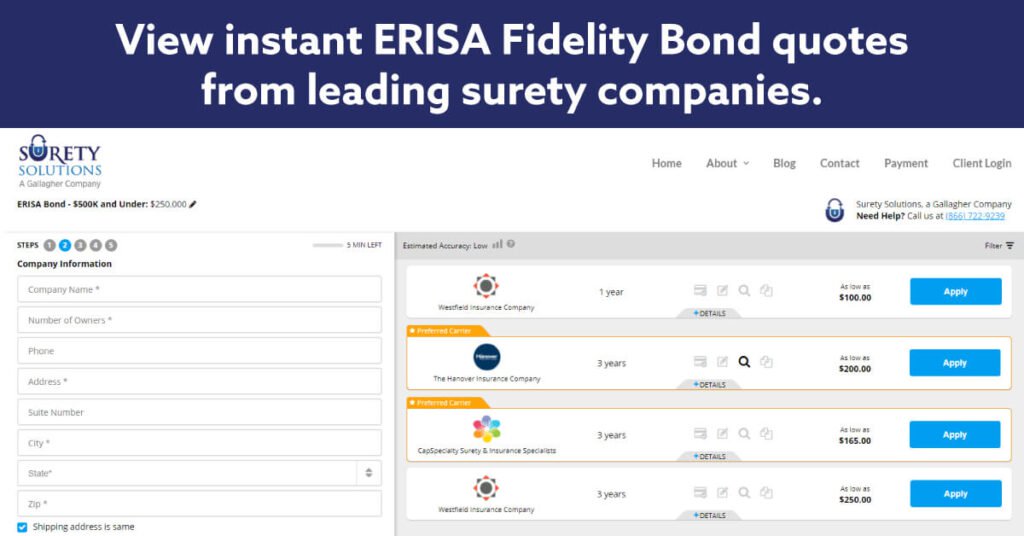

Click the quote with coverage best suiting your needs at the price that fits your budget. Afterward, you can purchase your bond and bind your coverage. The whole process can be done in under 5 minutes.

As you set that gallon of milk in your cart while grocery shopping, you think to yourself “can I get this cheaper at another store?” However, driving to another store for a possible better deal doesn’t seem worth the effort. You might feel the same while shopping for your ERISA Bond. However, comparing prices for your bond is easier than you might think.

Once you get a quote for your ERISA Bond, it’s tempting to make the purchase and move forward on completing your obligation with the U.S. Department of Labor. We get it. Your time is valuable and you don’t want to spend hours researching prices for your bond. But, did you know you can get multiple instant quotes from leading surety companies, all in one place?

You don’t need to spend hours finding and comparing quotes for your ERISA Bond. Just select the bond amount you need below to get instant quotes from leading surety companies.

Select your bond amount

Click the quote with coverage best suiting your needs at the price that fits your budget. Afterward, you can purchase your bond and bind your coverage. The whole process can be done in under 5 minutes.

When shopping for your bond, make sure to compare policies with each other. Not all Bonds offer the same types of coverage.

Details to compare:

Make sure the company issuing the bond is reputable. Do this by looking up the surety’s AM Best rating and/or Better Business Bureau (BBB) score. All of our surety partners have an AM Best rating of A or higher.

If your ERISA Bond includes Inflation Guard, you will remain in compliance with the U.S. Department of Labor if your plan funds increase mid-term without having to pay additional premium. All of our ERISA Bonds under $500,000 include Inflation Guard.

Not all bonds renew annually. Some bond terms are effective 2 or 3 years. Make sure to check the term length of the bonds when comparing prices. You may discover 1 bond is a little more expensive because it includes a longer term. We offer a discounted rate for our multi-year term ERISA Bonds.

The ERISA Bond amount you’re required to have needs to equal 10% of the total plan funds you handled the previous year. However, the minimum bond amount cannot be less than $1,000.

The bond amount and cost of the bond are different. So, you won’t have to pay the full bond amount. We offer ERISA Bonds starting as low as $100. Although, there are a couple of factors to consider when calculating the cost of your bond.

• Bond Amount: If you require a larger bond amount, more risk is associated with the policy, resulting in higher premium.

• Term Length: You can select 1 to 3 years for the length of your bond term. Get a discounted rate for your ERISA Bond when you purchase a multi-year term bond through Surety Solutions, A Gallagher Company.

You can get your ERISA Fidelity Bond at suretysolutions.com to compare instant quotes with top surety companies. We’ve made getting Surety Bonds quick and easy since 2004. As of 2019, we became a part of Arthur J. Gallagher & Co., one of the largest insurance brokers in the world. You can shop in confidence knowing you’re getting the best deal for your bond.

See what our clients are saying about their experience getting their bonds.

Getting quotes for your ERISA Fidelity Bond is fast and simple.

Pick the bond amount you need using the drop down below.

You’ll receive instant quotes from our surety partners. All of these policies include inflation guard, but may have different term lengths. Get a discounted rate when purchasing a multi-year term bond.

Once you select the quote you want, we’ll need just a little bit more information to process your bond. ERISA Bonds under $500,000 do not require a credit check, so we can bind your coverage immediately after you purchase.

Getting your ERISA Bond doesn’t have to be difficult or time consuming. Viewing quotes from multiple surety companies ensures you pay the lowest price for your bond.

Get the best deal on your ERISA Bond, today!

Have questions about your ERISA Fidelity Bond? Call our office at (866) 722-9239 or send an email to info@suretysolutions.com to speak with a surety expert. Our team is licensed to issue bonds in all 50 states.

The Employee Retirement Income Security Act of 1974 (ERISA) is in place to protect the interests of those participating in an employee benefit plan. Read more…

Where ever you get your bond, you want to make sure you’re working with a reputable Surety Bond company. Read more…

To understand Fiduciary Bonds, you’ll need to understand what, or rather who, a fiduciary is. Read more…

Beau is the Marketing Content Developer at Surety Solutions, A Gallagher Company. He creates content about all types of surety bonds, including mortgage, court, lost title, contractor, fidelity, ERISA and many more.

Secured by SSL.

Email: customercare@suretysolutions.com

4285 Commercial Street SE

Suite 110

Salem, OR 97302

(866) 722-9239