You’re well on your way to getting your Colorado Mortgage Loan Originator License. At this time, you’re probably aware of the Colorado Department of Regulatory Agencies: (DORA) Division of Real Estate list of requirements to get your Mortgage Loan Originator License.

Of these requirements set by DORA, you’ll need to get your Mortgage Loan Originator License Bond and Errors & Omissions (E&O) Insurance. Fortunately, this is the easiest and quickest requirement to meet.

The DORA Mortgage Loan Originator License requirements include:

• Receive a Nationwide Multistate Licensing System & Registry (NMLS) Number

• File your fingerprints with the Colorado Bureau of Investigations and the NMLS

• Complete pre-licensing education and written exams

One of the last steps is to get your Surety Bond and E&O Insurance.

Regardless of your experience with the industry, getting your surety bond through Surety Solutions, A Gallagher Company is quick and easy!

Setting up a mortgage is a big responsibility and your clients want to ensure you won’t take advantage of them. Therefore, being bonded with the state proves you’re operating as a responsible and ethical Mortgage Loan Originator to your clients.

Unlike traditional insurance, the surety bond is not protection for you, but instead protection for your clients and the state. If your client believes you’re performing shady business practices or you fail to meet your obligations as a Mortgage Loan Originator, they can make a claim against your bond.

In the event of a claim, the surety company holding the bond will initiate an investigation. When a claim is found to be valid, the surety will pay out up to the full bond amount. Although, the surety company expects you, as the principal on the bond, to reimburse them.

Due to this bond requirement, your clients are safe from fraud and the state of Colorado is not financially responsible when a valid claim is made.

Whereas the Surety Bond is protection for your clients, the Error & Omission (E&O) Insurance applies to you. Not only is it in your best interest to have this type of insurance, but E&O Insurance is a Mortgage Loan Originator License requirement.

Your E&O Insurance will not protect you from the following:

Buying your CO Mortgage Loan Originator Bond is quick and easy!

The first step is to determine the bond amount you need.

If this bond is just for your license as an individual, you’ll need a $25,000 surety bond.

If you’re looking for a bond for your company with 2-19 licensees, your bond amount needs to be $100,000.

If you need a bond for your company with 20 or more licensees, the bond requirement is $200,000.

Now that you’ve determined the bond amount you need, you can view your instant quotes and purchase the policy that best fits your needs. Fortunately, you won’t pay the full bond amount. Our bond premium rate starts as low as $100.

Please note: Your first term of the bond is fully earned. We are unable to issue a refund, full or partial after your purchase is complete.

Absolutely!

Your E&O Insurance is a separate transaction, but we can set you up with your bond and insurance.

As a licensee, the state requires you have minimum E&O in the amount of $100,000 per occurrence and a minimum aggregate limit of $300,000. However, we offer this insurance policy at $500,000 with no additional costs. Starting as low as $220, you’ll satisfy the state’s guidelines.

Before purchasing your Surety Bond or E&O Insurance, we recommend verifying your company doesn’t already have blanket bond and/or E&O Insurance for all of their employees.

Your policy is fully earned for the first term after purchase. A refund, either full or partial, cannot be issued for your policy after purchase.

The 3 key factors to review when deciding on your quote is the surety company, term length and cost. You’ll save more on your bond by selecting a multi-year term.

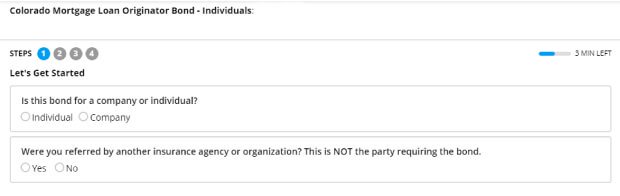

We need a little information from you to issue your bond and/or policy. Therefore, please answer all the questions listed in each 4 steps to the left of your quotes.

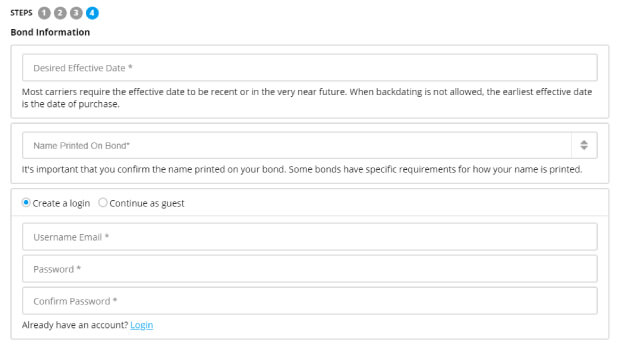

On step 4, select the date you want the bond to become effective. Then, select how you want your name to appear on the bond using the drop down field. How your name appears on the bond should match up with the NMLS.

If you don’t already have an account with us, you can create one now or checkout as a guest. Although, we recommend creating an account, so you can access and download your bond/policy documents at your convenience. Also, by creating an account, your information will auto-populate when you start a new application.

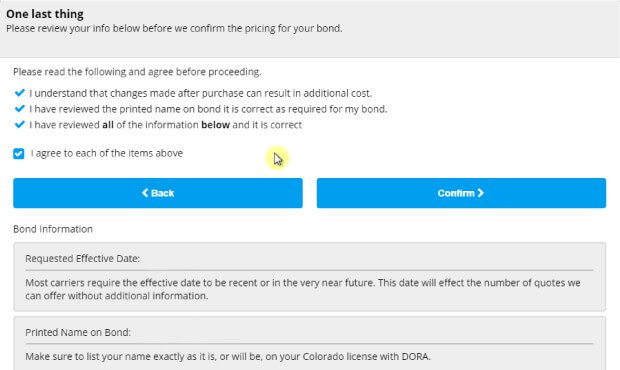

Please make sure the information you entered is correct before submitting your application. If you experience any issues editing your information, please contact us for assistance.

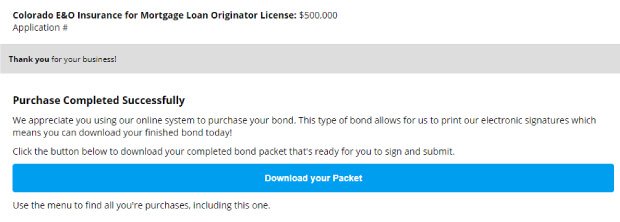

After you confirm the information entered is correct, you can complete your purchase by submitting payment. Once your payment is processed, you’ll be able to instantly download your packet containing your bond or policy.

We recommend you create a free account, so you can login and download your packet(s) at anytime.

Once you purchase your Surety Bond and/or E&O Insurance, you’ll receive electronic copies of both for your records. Please verify the information on your documents are accurate before you submit them online.

Afterwards, visit the CO DORA website to update your Colorado License information, so the state knows you have the insurance. If you find any inaccurate information on your bond or policy purchased using our application, please contact us to request changes.

With Surety Solutions, A Gallagher Company, you choose the instant quote that best fits your needs and price point. Due to our partnership with the top surety companies, we offer competitive prices on our bonds and E&O Insurance. Our surety partners include Westfield Insurance Company, CapSpecialty Surety & Insurance Specialists, The Guarantee, The Hanover Insurance Company, CRES Insurance Services and many more!

For this reason, we’re able to offer our CO Mortgage Loan Originator Bonds starting as low as $100. Or, you can select a multiyear term bond for a greater discount on your bond premium. After you purchase, you’ll receive your Surety Bond and/or E&O Insurance electronic documents instantly.

Not convinced? See what our clients have to say about us on Google:

If you have any questions about our application, Surety Bond or E&O Insurance, send us an email to info@suretysolutions.com or call our office at (866) 722-9239. We’re always happy to help!

For licensing questions, please contact the Colorado Division of Real Estate Licensing Staff by calling (303) 894-2166 or sending an email to real-estate@dora.state.co.us.

Getting your Mortgage Loan Originator License is a great start to a new career. The barrier of entry is low, with no college degree necessary. Because you just need to meet the CO DORA requirements to get your license.

Once you have met all of CO DORA’s requirements and submit your electronic Surety Bond and E&O Insurance documents, just wait for approval to receive your Colorado Mortgage Loan Originator License

Use our online application to get your Surety Bond and E&O Insurance within minutes!

Read our step-by-step guide on the process of becoming a Mortgage Loan Officer in Colorado. Read more…

What is a Colorado Mortgage Loan Originator Bond and how much does it cost? Read more…

Colorado Mortgage Loan Originators require E&O Insurance to receive their license. Read more…

Beau is the Marketing Content Developer at Surety Solutions, A Gallagher Company. He creates content about all types of surety bonds, including mortgage, court, lost title, contractor, fidelity, ERISA and many more.

Secured by SSL.

Email: customercare@suretysolutions.com

4285 Commercial Street SE

Suite 110

Salem, OR 97302

(866) 722-9239